2020 is arriving with even higher expectations from organizations looking to leverage Internet of Things (IoT) technology. IoT has become central to corporate strategy roadmaps and expectations have grown.

According to a recent IoT prediction, business leaders have grown more confident in IoT with more and more organizations skipping the IoT pilot phase in favor of initial implementations. One inference is that the value proposition of real-time data using IoT has been proven, and business leaders are now eager to move ahead with IoT solutions.

Innovative organizations know that IoT has the capacity of solving real, everyday problems. Far beyond technology for technology’s sake, IoT delivers practical results needed by enterprises poised to take leading roles in tomorrow’s marketplace.

Let’s look at some of the top IoT trends to watch out for in 2020.

1. Companies View IoT as the Key to Evolving in the Face of Industry Disruption

It is impossible to understand current IoT trends without recognizing broader industry trends that shape the marketplace. Companies inherently understand that they must continue to evolve in the face of industry disruption. Technological change only accelerates the rate of disruption. Monikers such as Industry 4.0 have become commonplace today as a signal for digital transformation.

It is estimated that only 33% of companies successfully navigate the change when industry disruption occurs. The other 67% went out of business, got bought, or stumbled through years of stagnating or declining value.

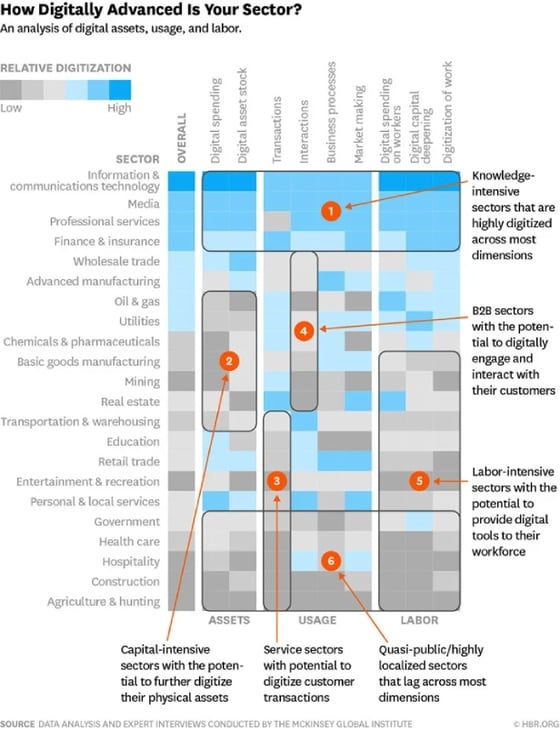

Those that embrace transformation will remain relevant to the future that rapidly approaches. Everyone accepts that the digitization trend has already affected their industry. The level of impact varies, of course, but the trend remains the same. In one survey, the relative impact of digitization across industry sectors has been charted. The results certainly point the way to broader trends impacting markets today.

IoT is key to digitizing physical assets, regardless of industry. Whether buildings, vehicles, HVAC equipment, construction sites, etc., IoT can produce operational efficiency using small data and big data.

The drive towards IoT will continue to expand because the digitization trend will continue to impact all business sectors. Innovative organizations know that IoT is the key to evolving in the face of pervasive industry disruption.

2. IoT Helps Companies Shift Their Focus from Products to Services

History provides too many examples of organizations that failed to adapt or recognize the shifts in the market. Today, the current corporate mantra of “Services, Services, Services” is impossible to ignore. Between 2016 and 2020, the global XaaS market was forecasted to grow by 40 per cent each year. History threatens to repeat as the lessons of hardware-centric thinking may not be learned.

IoT is not a respecter of business traditions. IoT provides the tools to pivot corporate strategies from products to services. As the lowest-cost provider of real-time data, IoT will fuel the XaaS market. IoT can use inexpensive wireless microcontroller (MCU) devices to extract real-time operational data, seamlessly transport the data to the cloud, and launch a host of real-time application service opportunities.

Cloud delivery of real-time services is the new normal. Due to the smart phone in your hand, everyone has grown accustomed to having real-time data and services at their fingertips. Our expectations have changed because we now assume and expect anytime, anywhere access to virtually everything.

Cloud delivery of real-time services is the new normal. Due to the smart phone in your hand, everyone has grown accustomed to having real-time data and services at their fingertips. Our expectations have changed because we now assume and expect anytime, anywhere access to virtually everything.

Companies that cannot proactively solve their real-time data problem in their new XaaS roadmap risk obsolescence in today’s market. IoT has grown far beyond a market niche because real-time data is increasingly demanded across the landscape of industries. IoT is the key for companies to pivot to the market for real-time services.

3. IoT is the Key to Unlocking New Customer Value

Digital transformation using IoT is eminently practical; it enables companies to unlock new customer value through the delivery of advanced real-time services. Let’s consider an example of how IoT can unlock new customer value in the service maintenance markets.

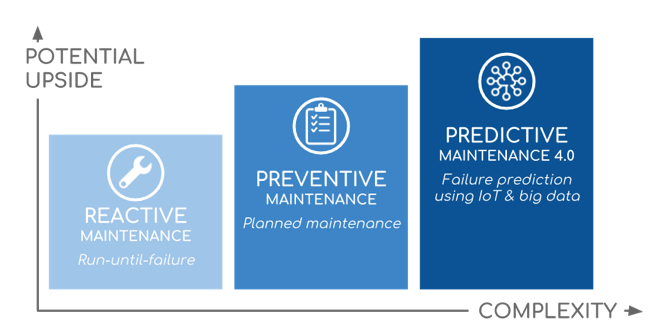

Historically, maintenance is performed reactively, when a failure actually occurs. This maintenance regime typically bears the highest costs both from the cost of the repair itself and the impact of the failure on various stakeholders. Many organizations have since adopted preventive maintenance programs, which rely on routine, planned maintenance (e.g., every six months) in an attempt to fix problems that can lead to actual failures. Even with these preventive maintenance programs, failures still occur and the impact of those failures remain acute.

IoT has transformed today’s maintenance markets by ushering in the predictive maintenance regime. Big data enabled via IoT can now enable failure prediction. Not only will IoT provide real-time insight into the current operating condition of equipment, but IoT can also enable the application of Artificial Intelligence (AI) with Machine Learning (ML) to predict the potential occurrence of failures before they manifest. With this predictive intelligence, repairs can be scheduled before catastrophic failures occur, thereby eliminating the high costs of reactive maintenance.

Service organizations across industry increasingly recognize that IoT can enable new forms of real-time services such as predictive maintenance to unlock new customer value from their existing customer base. Those service organizations that offer these advanced real-time services will quickly take leadership positions as they pivot their organizations. Service organizations that fail to offer these advanced real-time services will eventually stagnate, decline in value, and face the real possibility of going out of business.

4. Innovators Look Beyond Vertical IoT Products

Innovative organizations understand how real-time data will enable them to advance the real-time service framework they envision in their market segment. Their service roadmap is typically unique because their domain expertise enables them to see the opportunity to break open new markets and unlock new customer value.

The conundrum they face is that IoT products on the market are typically narrow in focus and do not meet their particular real-time data needs. Actually, the bigger problem with vertical IoT products is that they represent someone else’s vision of what you want to buy. Comically, the early wave of IoT has produced some decidedly bad IoT products.

For modern enterprises, purpose-built vertical IoT products miss the mark. They frequently give you data you don’t really need, and don’t give you the data you really need! It is a conundrum, and reflects the fact that digital transformation leaders are attempting to break open new markets. This is not yet a commodity business where purpose-built IoT products are readily available to meet their needs. Innovators will increasingly look beyond vertical IoT products.

For modern enterprises, purpose-built vertical IoT products miss the mark. They frequently give you data you don’t really need, and don’t give you the data you really need! It is a conundrum, and reflects the fact that digital transformation leaders are attempting to break open new markets. This is not yet a commodity business where purpose-built IoT products are readily available to meet their needs. Innovators will increasingly look beyond vertical IoT products.

5. Companies Will Increasingly Choose to Develop Their Own Unique IoT Solution

Unable to find a vertical IoT product that meets their unique real-time data needs, organizations will increasingly look to build their own custom IoT solution. In this manner, organizations will be able to control their IoT solution roadmap and not be reliant on ill-fitting, third-party IoT products.

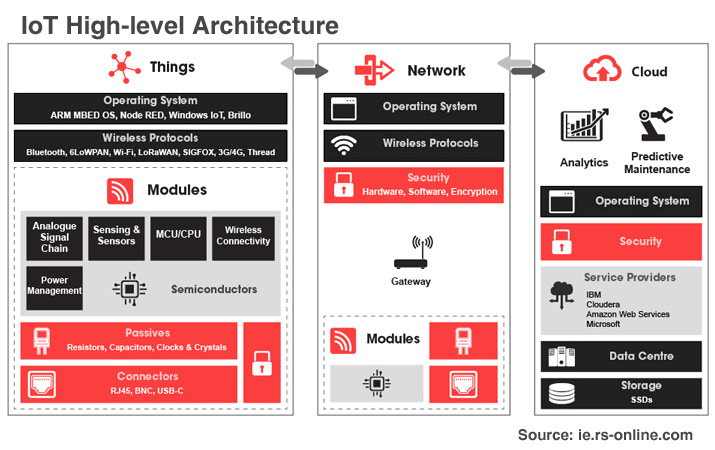

The investment in new technology to accomplish their corporate strategy roadmap is not a new phenomenon. If anything, it is a perfectly natural response. The question those organizations must grapple with is the cost of developing their own IoT solution. In one scoping example, the IoT system can be broken down into three levels:

- Hardware (various objects enhanced with firmware/embedded systems and smart sensors).

- Infrastructure (a piece of software that receives, analyzes and stores sensor data; it runs in the cloud or on a corporate server).

- Apps (applications for smartphones, tablets and PCs that connect hardware to the infrastructure and enable users to manage smart gadgets).

Unfortunately, the true costs for developing a custom IoT solution is far greater than the development costs for the Hardware, Infrastructure, and Apps. The true costs must factor in risk. For example, how much does one invest in an IoT development program when the potential value of new market opportunities remains unknown? Said another way, what is the probability of capturing a true ROI when the market opportunity is currently speculative for the innovator?

Unfortunately, the true costs for developing a custom IoT solution is far greater than the development costs for the Hardware, Infrastructure, and Apps. The true costs must factor in risk. For example, how much does one invest in an IoT development program when the potential value of new market opportunities remains unknown? Said another way, what is the probability of capturing a true ROI when the market opportunity is currently speculative for the innovator?

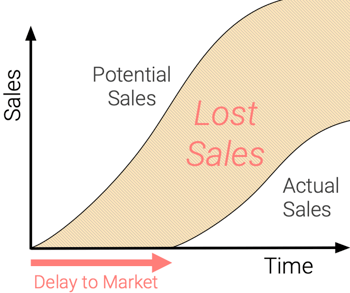

Notwithstanding those risks, service organizations know that they must adapt or die when responding to industry disruption. The real risk is therefore time. Enterprises are under pressure to execute on their corporate roadmap, which typically factors in a 12-24+ month timeline to develop a scalable IoT solution for their own particular use. This development timeline delays their time to market, which can lead to lost sales as compared to those market leaders that have already pioneered into the new service markets.

Notwithstanding those risks, service organizations know that they must adapt or die when responding to industry disruption. The real risk is therefore time. Enterprises are under pressure to execute on their corporate roadmap, which typically factors in a 12-24+ month timeline to develop a scalable IoT solution for their own particular use. This development timeline delays their time to market, which can lead to lost sales as compared to those market leaders that have already pioneered into the new service markets.

Companies that are grappling with the decision to develop their own unique IoT solution must balance the inherent market risks that tempers their development investment.

6. Out of Necessity, IoT Development Kits Will Grow in Popularity

IoT development kits represent a growing trend aimed at helping innovative organizations shorten their IoT solution development timeline. These development kits are typically based on inexpensive MCUs and enable companies to build and test a prototype of an IoT device that is targeted to their particular real-time sensor application.

For example, AWS introduced Amazon FreeRTOS, which is an IoT operating system for MCUs to securely connect to AWS IoT Core. The AWS partner device catalog includes 14 evaluation and development kits that can prototype MCU-based IoT solutions. Similarly, Microsoft Azure introduced Azure Sphere (see right), their version of an IoT operating system for MCUs to securely connect to Azure IoT Hub. Finally, Google Cloud has worked with their partners to build a number of starter kits to make it easy for developers to connect to Cloud IoT Core.

For example, AWS introduced Amazon FreeRTOS, which is an IoT operating system for MCUs to securely connect to AWS IoT Core. The AWS partner device catalog includes 14 evaluation and development kits that can prototype MCU-based IoT solutions. Similarly, Microsoft Azure introduced Azure Sphere (see right), their version of an IoT operating system for MCUs to securely connect to Azure IoT Hub. Finally, Google Cloud has worked with their partners to build a number of starter kits to make it easy for developers to connect to Cloud IoT Core.

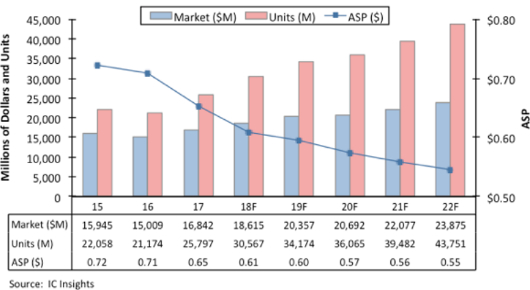

The market for IoT development kits has grown and the usage of inexpensive MCUs for embedded sensing and control is expected to expand. As such, the MCU sales projections herald a CAGR of 11.1 percent to about 43.8 billion units by 2022. Currently, the level of penetration of MCU-driven IoT applications is minuscule compared to the coming IoT market (e.g., $1.2 trillion in IoT spending in 2022).

The rising interest in IoT development kits not only signals the increased reliance on IoT in the face of industry disruption, but also signals a recognition that existing vertical IoT products on the market are not sufficient to meet their needs. Hence, the IoT customers having domain expertise in their industry segment are facing the inevitable prospect of being forced to undertake their own development of an IoT solution suited to their needs.

The rising interest in IoT development kits not only signals the increased reliance on IoT in the face of industry disruption, but also signals a recognition that existing vertical IoT products on the market are not sufficient to meet their needs. Hence, the IoT customers having domain expertise in their industry segment are facing the inevitable prospect of being forced to undertake their own development of an IoT solution suited to their needs.

7. True IoT Platform Solutions Will Evolve to Enable Adopters to Focus Upmarket

IoT cloud platforms such as AWS, Azure and Google are in the process of extending their reach to the premises via MCUs that can facilitate customer-specific sensing and control functionality. The level of integration varies, but the intent becomes clear. The latest battleground between IoT cloud platforms revolves around control at the OS level of MCUs.

The key question does not revolve around proprietary vs. open source software licenses in the MCUs. The key impetus is much simpler. IoT cloud platforms appear to recognize that potential OS revenue from the MCUs pales in comparison to the value of providing a frictionless path to enable real-time data streams to connect to their IoT cloud platforms. Once connected, IoT service revenue from hosting, dashboarding, alerts/notifications, analytics, on-site controls, etc. will flow.

The rise in IoT development kits points in this direction, but still suffers a flaw. Yes, IoT development kits can shorten the development timeline of a scalable IoT solution to as little as 12 months. That represents an improvement.

The problem with this current IoT platform model that depends on IoT development kits, however, is that it forces their customers to focus down-market onto the intricate details of supporting an IoT hardware device ecosystem. This can ultimately represent a distraction. The premise on which the entire IoT solution is dependent upon is to drive high-margin, real-time application services in the cloud. That is the core business focus. To take responsibility for maintaining the continued development of an IoT hardware device ecosystem is antithetical to their corporate roadmap. This conflict will continue to incentivize a divergence between the two focuses: up-market vs. down-market.

IoT cloud platforms will continue to evolve as they seek to provide a frictionless IoT solution at the device level that obviates the need for IoT development kits. When IoT solutions replace IoT development, then the IoT market driven by evolving enterprises with domain expertise will accelerate quickly.

Conclusion

Business leaders have increased confidence in IoT. More and more organizations have skipped the IoT pilot phase in favor of initial implementations. For those that are convinced, the next leg of IoT has already begun. We expect these current IoT trends to distinguish the winners and losers in the growing IoT market.